In this Edition

Construction

Management Specialists

111 Pine Street, Suite 1315

San Francisco, CA 94111

(415) 981-9430 (San Francisco office)

6518 Lonetree Blvd., Suite 164

Rocklin, CA 95765

(916) 742-1770 (Sacramento office)

9449 Balboa Avenue, Suite 270

San Diego, CA 92123

(619) 518-5648 (San Diego office)

8538 173rd Avenue NE

Redmond, WA 98052

(206) 571-0128 (Seattle office)

2063 Grant Road

Los Altos, CA 94024

(650) 386-1728 (South Bay office)

7083 Hollywood Blvd., 4th Floor

Los Angeles, CA 90028

(424) 343-2652 (Los Angeles, CA office)

78 Heathervue, Greystones

Wicklow, A63Y997, Ireland

+353 86-600-1352 (Europe office)

www.TBDconsultants.com

In this article we look at microgrids, which can keep your building function when the power grid goes down, and pay you by supplying power to the grid.

Bitcoin has been even more volatile than the stock market, but the technology behind it can provide a stable platform for transactions. Here we look at how the blockchain might be be implemented in the construction industry.

Writing at mid-February, the stock market has been showing extreme volatility, with record-breaking drops in points. We had the worst ever points drop for the Dow, and the second worst, all in one week. But does volatility equate to the start of a recession? Are the boom times coming to an end? The answer seems to be, ‘Not yet’.

Escalation in construction costs has been rising fairly fast for the past few years, but the signs of wage growth are leading to fears that general inflation will start to pick up as well. In fact, inflation has gone up to about 2.1%, marginally over the Federal Reserve’s target. Rising wages could eat into some of the corporate profits, and inflation could give the Fed a good reason for increasing the pace of interest rate rises. Currently, the level of inflation means they can continue their slow and steady rate increases, but if it rises much above their target level of 2% they could accelerate the rate rises. The expectation is that inflation will increase in all of the developed world as the labor market tightens.

Bond yields (such as those for the 10-year Treasury note) have been rising, giving concerns that rising borrowing costs might slow the economy. The tax bill and the budget deal are going to make it necessary for the Treasury to borrow more money, by issuing more bonds. Such an increase in supply results in a drop in price, and corresponding increase in yields, which makes them more attractive as an alternative investment to stocks. Bond yields rise as central banks ease back on the stimulus programs that helped us out of the Great Recession. Raising interest rates are part of that, and the Fed is also selling Treasury notes it purchased through its quantitative easing program. Business has got used to low, almost non-existent, interest rates, but that does not reflect the reality of a healthy economy.

The latest job report showed the strongest growth for more than 8 years, and there are now more job vacancies open than there are people to fill them. The problem is that often the people available don’t have the skills or the inclination to take the available jobs. Encouraging training programs, to help workers gain new skills, was a priority for former Fed chairperson, Janet Yellen.

Business confidence and consumer confidence both remain high, and global economic growth has gained steam. In the U.S., 4% growth is predicted for the first quarter, and the European Union grew at the fastest rate in a decade (2.5%) in 2017. So, there are no signs of an immediate recession, but the fear is that the economy could overheat.

There do remain some fears of trade wars (which might be starting; tariffs could push steel prices up around $300/ton) and international tensions that could derail the economy. Also, there is some concern that, as cheap money ends, some companies may find their fundamentals are not as strong as they thought.

All the incentive packages should boost business and the economy, and therefore boost stocks. But they also may increase inflation, and lead to more rapid rises in interest rates, which are not good for business because they make finance more expensive. So, stocks could go up, or they could come down, and we’re seeing both at present (sometimes in the same day).

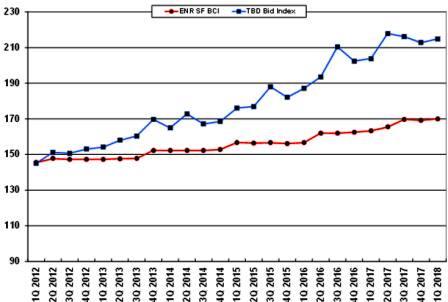

More specifically on the construction front, the Architecture Billings Index remains in positive territory, although perhaps showing a bit of a slowdown. Statistics on construction starts continue on an upward trend but are showing more volatility (ups and down in the graph). The CONFINDEX report shows that confidence within the construction industry remains high, even though down a bit from the year before, and there is more concern about how things might get in 2019. When things seem to be going too well, we tend to expect them to change. And we know that things will change, but there doesn’t appear to be any reason to believe they will in the near future.

Geoff Canham, Editor, TBD San Francisco

Design consultant: Katie Levine of Vallance, Inc.